How Home Builders Are Working Around Record-High Lumber Prices

Rising lumber prices are forcing home builders to change the way they conduct business.

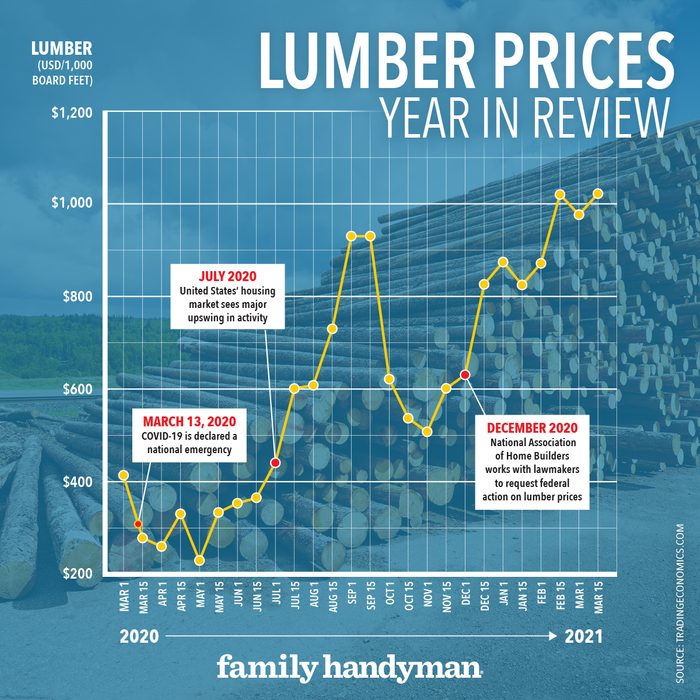

Since the onset of the coronavirus pandemic in early 2020, lumber prices in the United States have increased over 200 percent. The National Association of Home Builders recently sent out a survey asking home builders what steps they are taking to mitigate the effects of this ongoing escalation in lumber prices.

“It’s been a difficult time for us and homeowners,” Jeremy Burke, a remodeler in Pennsylvania, told the NAHB.

According to the NAHB, just under half of the surveyed home builders have begun including price escalation clauses in their contracts in order to help limit some of the risk presented by the continued climb of lumber prices.

“We have had to prepare contracts with clauses for material change orders when materials cost rise — which I fear means we will lose contacts and/or projects for those who can’t afford the extra costs,” said Burke.

Twenty-nine percent of builders reported that they have been pre-ordering lumber in order to lock in prices before they increase even further, while 22 percent say that they have worked with lumber suppliers to guarantee prices for a set period of time. Even with these measures, 19 percent still reported that they simply have had to delay building and sales of homes when lumber prices spike.

“We have always prided ourselves on being able to provide affordable housing to our local market, while also being financially prudent to the best practices in the building industry,” Colorado-based builder Michael Welty told the NAHB. “When you couple these price increases with the limited amount of supply that currently resides in our housing market, the current conditions are creating an escalating market that in our opinion will eventually be unsustainable.”

Unfortunately, market experts are not expecting lumber prices to return to any level of normalcy any time soon. Dustin Jalbert, senior economist at Fastmarkets RISI, recently told Fortune that he believes the market is in trouble and “could spiral out of control in the next few months.”