Know When Homes Sell

The first step in buying a new house is selling your current home. An important part of this process is knowing when people are likely to put their homes on the market, then using it as a guide for when to buy your new home.

If you’re looking for the overall best time to sell, the experts at Sundae recommend, “in most places, the first two weeks of May are when homes sell the fastest and for the highest price. April and June also stand up to May’s record, making Spring a great time to list your home for sale.”

Consider Renting

Buying a house isn’t always the best option. If you’re only planning on staying in a home for a couple of years, renting may be a better option for you.

You’ll also need to consider your personal finances. You may be able to afford your monthly mortgage payments, but can you afford unexpected repairs such as a flooded basement or damaged roof?

Don’t Max Out Your Budget

Just because you’ve been approved for a $300,000 mortgage doesn’t mean you should buy a $300,000 home. You’ll need to consider expenses for closing costs, taxes, insurance, repairs and monthly bills.

Buy a House in an Area You Know

You shouldn’t just love the home, you should also love the neighborhood. Not knowing the area and feeling unsure about the neighborhood can be red flags for home buyers.

Appreciation Isn’t Guaranteed

Since housing markets go up and down, it doesn’t mean that when you’re ready to sell you’ll make money. Appreciation isn’t guaranteed when it comes to residential real estate, so consider the long-term when buying.

Don’t Skip the Home Inspection

If the home looks flawless, it may be tempting to pocket that $500 you would spend on an inspection. Don’t. Home inspections are worth the investment. They can flag problems you may not otherwise see and give buyers peace of mind.

Get Pre-Approved

If you want to be taken seriously in your home search, you need to be pre-approved by a lender. This will tell sellers that you’ve taken the necessary steps financially to qualify for a mortgage. In some markets, Realtors won’t even work with buyers who haven’t been pre-approved.

Understand Down Payments

The days of putting zero down are gone. At minimum, depending on your lender, you’ll likely need five percent of the selling price as a down payment. Also, you’ll want to keep some money on hand for closing costs and an emergency fund.

If you can’t put 20 percent down when buying a house, you may need to pay private mortgage insurance (PMI), so it’s best to understand the down payment terms.

Keep Shopping

If you love the first home, that’s great, but check out multiple homes. It’s important to look at a few houses so you can compare pros and cons. Viewing more homes will give you a better understanding of your options, likes and dislikes.

Know Your DIY Limits

When it comes to buying a house that needs repairs, consider what you’re willing to deal with and what you’re not.

Perhaps you feel comfortable purchasing a home with an old roof, but lead paint isn’t an option for you. If the home needs some work, understand the costs associated with the needed repairs.

Get a Second Opinion

Sometimes it’s best to get a second (or third) opinion when looking at a home. A friend or family member may be able to point out things you didn’t see, such as a yard drainage issue or that mold in the corner of the basement.

Know What You Can and Can’t Live With

If this is your first home, consider what you can live with and what you can’t. Perhaps the kitchen isn’t ideal, but you know a few appliance upgrades will do the trick.

You wanted two full bathrooms, but can you live with one and a half? Know your must-haves.

Keep Emotions in Check

Buying a house is stressful, and buying in a competitive market makes it even more so. It’s important to keep your emotions in check, as you may end up overlooking some costly issues and overpaying for a home if your feelings cloud your judgment.

Shop Seasonally

Any real estate agent will tell you that making an offer in early spring or summer will result in a higher price for your home, but there are often many more variables to buying in the right season.

If you do choose to search and purchase in the winter, when most eligible home buyers are snuggled in front of their fireplace, you’ll likely have less competition. However, you’ll also find fewer homes to choose from due to less inventory in the low season.

If you buy in the high season, you’ll have many more homes to choose from, but will fight stiff competition as everyone dons their flip flops for whole days of open houses. Follow these eight steps if you’re looking to buy your first home.

Don’t Judge a Book by Its Cover

Let’s face it, some homes show horribly. Some have old carpet, some have peeling paint and some just downright stink. But just because a house looks bad, its current condition doesn’t mean there isn’t value there.

While you’re viewing a property, peek under carpets to check for original hardwood flooring and other historical details, like crown molding.

If you’re lucky enough to have a friend in construction, have them take a look at the house’s foundation to determine if it will still be standing upright in another 100 years.

Learning if a house has good bones will help you look past the cover image on an otherwise dingy dust jacket.

Set Up Multiple Viewings

If you find a home you like and you have time to consider making an offer (like during low season), it’s important to visit the house several times before you make your decision.

Check out the house on a sunny day to determine if the windows let in natural light. Then race over when it’s raining to confirm that the basement doesn’t leak.

These thorough viewings will let you know what it will be like to live in the house year-round. Keep in mind that some water issues are easy to fix, while others can be costly. Learn more about getting better yard drainage here.

Use an Agent

If you’re serious about buying a home, hire a real estate agent. There’s no reason not to. This person is a professional who will not only schedule and accompany you on showings, but guide you through on the entire buying process.

Plus, they work on commission, which the seller usually pays. In those cases their service to you is free. Nothing to lose! Get tips on doing your own home inspection here.

Know the Difference Between Pre-Qualification and Pre-Approval

If you’re serious about buying a home and not just trolling the market, be sure to get pre-approved by your bank or credit union BEFORE you start viewing homes.

Also, be sure to obtain pre-approval instead of just pre-qualification, which is simply a preliminary letter from your bank without the official credit check, etc. With pre-approval, you will be ready to make an offer when a home feels right, which is crucial if there’s heavy competition.

You’ll also know exactly what you can afford, which is really the most important thing. Learn more about buying a DIY-friendly home here.

Don’t Ignore Old Paint

Though sellers are required to fill out a lead-paint disclosure form in most states, if the home you like was built before 1978, you should seriously consider its potential for lead-based paint.

On one of your showings, take a lead-paint test kit with you to swab a few areas that seem suspicious (flaking, zebra-like chips). You can buy tests for a few bucks at your local health department. Get full instructions on how to test for lead paint here.

If you have time and the ability, also test the water to ensure the tap water doesn’t contain lead as well.

Don’t Skip the Final Walk-Through

Most purchase agreements allow for a final walk-through of the property to ensure that the house is still in good condition. This might not seem necessary, but if you’re purchasing a foreclosed property or displacing disgruntled renters, you may need to ensure that no last-minute damage was done. (Think writing on walls, stolen appliances, etc.).

Be Neighborly

In some communities, neighbors can make or break your home purchase. In a good neighbor, you can have a friend, a confidant and sometimes even a babysitter.

Neighbors, if they’ve lived near your potential home for a few years, can also offer background about previous owners or tenants and any damage they might have done. Were there ever bats in the attic? Was there lead remediation? Radon problems? Your neighbors might know all the dirty details.

So don’t be afraid to be friendly and ask. You can still maintain your privacy in the home after purchase. Check out this project on how to build a patio privacy screen.

Don’t Force It

When you’re excited about buying a home, it’s easy to envision yourself living in one you just like, even if it’s not the right property for you. Don’t try to squeeze your family into a house without the right amount of bedrooms, for instance, just because you like the neighborhood.

The right home will come along eventually, and when it does, you’ll be ready. Make sure you don’t regret anything when you buy a house.

Appraisal Fee

An appraisal fee will run about $300 to $500 and will show up on a loan estimate or good faith estimate. Most of the time the appraisal fee is paid out-of-pocket but it can sometimes be rolled into closing.

See If a Survey Fee Is Required

Flood Determination Assessments

A flood determination assessment is usually around $10 to $20 and helps lenders determine if a property is in a flood zone.

Lenders have to get a flood determination assessment to determine if the home has the proper amount of insurance. Know what to keep an eye on with a first-time buyers guide to home maintenance.

Escrow Fee

The closing fee is paid to the title company, escrow company or attorney conducting the closing. Some states require a real estate attorney be present at every closing.

This is a fee that is separate from the escrow deposit, which requires up to two months of property tax and mortgage insurance payments.

Be Wary of Application Fees

Some lenders use a mortgage application fee of $400 to $500 to try to get home buyers committed to them. Investopedia calls it an excessive fee that should be avoided.

Credit Report Fee

Origination Fee

An origination fee is usually collected after a loan is approved as part of the closing costs. It’s between .5 and one percent of the sale price. The origination fee typically covers the cost of paperwork, verifications and calculations to figure out the mortgage. Find out what to know about down payments.

Attorney Fee

Mortgage Broker Fee

If you choose to work with a mortgage broker, it’s going to cost you. A mortgage broker can help you find a loan, but they’ll charge you one to two percent of the home’s purchase price. Learn about property taxes before you start paying them on your new house.

Prepaid Interest

Between the time you close and make your first mortgage payment, lenders will likely expect you to pay any interest that accrues during that time. Sometimes you’ll have to pay it upfront at closing.

Buying a home for the first time? Learn some handy tips for home ownership.

State Recording Fee

The sale of the property needs to be recorded with your local government and you can be sure there are fees associated with that. Check with your county and city government to learn those fees.

Lender’s Title Insurance

Also known as a loan policy, lenders will require it to protect themselves if there’s an error in the title search or if there’s a claim of ownership on the property after it’s sold. Find out what every homeowner should know about a home.

Owner’s Title Insurance

Know When to Take Advice

When you start looking for a home, you’ll usually find people with a lot of opinions. It’s important to ignore everyone except those who provide grounded advice.

Family and friends who have bought one house decades ago probably don’t know all the important details of today’s home-buying process. People who have worked in real estate, home improvement and title industries for years probably do know their stuff, so listen to them.

When you pick a Realtor, pick one who comes with strong recommendations from around the area and years of successful representation among buyers. It’s far too easy to find a Realtor who’s just in it for a quick buck.

Don’t Buy Too Big

Never, no matter how tempting it is, buy a bigger space than what you currently need (expected family growth included). A big house just means there’s more space to maintain, higher utility bills to pay and more things that could go wrong.

Think about where you’ve lived before and how much space your belongings really require. If all of the homes you are looking at are larger than you need, consider looking at condos or townhomes.

Learn From Your Pre-Approval Number

Getting pre-approval for a loan isn’t a lock. But it does give you a good idea of what sort of mortgage you can handle, making this an important step.

Your mortgage approval numbers will also dictate how much you need to consider for a down payment — usually around 20 percent, but that varies for some government FHA loans and individual deals made with sellers.

If you find a house that’s over your loan pre-approval limit, or you cannot afford putting 20 percent down as cash, it’s time to move on. It’s vital that you stay within your means, no matter how much you fall in love with a house.

Listen to Your Home Inspector

A home inspection isn’t just a formality. Inspections frequently uncover serious issues, including foundation problems, rot, pest issues, roof damage, mold, improper insulation, out-of-date wiring and much more.

You need to know about these issues before you make a final decision. The good news is that a problem often leads to a new offer with the condition that the seller pays to fix the issue before you officially buy it.

Experience the Neighborhood

Take a walk! Go a few blocks in every direction and see what there is to see. How do the houses look? What’s going on in the yards? Are neighborhoods being built up and refined, or are they run down and getting worse? What’s the average age of the people you notice?

If what you see makes you uneasy, reconsider buying a house there. You should also take a look at the neighborhood’s crime ratings and median home prices.

Take Appliance Age Into Account

Appliances are some of the most expensive portions of the home and deserve a closer look. Generally, if an appliance is greater than 10 years old, replacement time is coming.

This applies to ovens, refrigerators and other important fixtures. Also, always make sure that the appliances you see will actually be staying in the house after you buy it. (Some sellers can be sneaky about this.)

And keep this article nearby after you buy a home, in case you need to make appliance repairs!

Consider Proximity to Work and Schools

Check the routes to work and nearby schools as necessary. Note any public transportation stops as well.

Don’t just look at a map. Travel the routes yourself and see what they’re like, how busy they are and how much time it will take during the time you’d actually commute.

Note Which Way the Windows Face

A small but surprisingly important detail, this dictates how much sun the house gets, when it gets it (morning or afternoon) and how hot the house becomes if you leave all the windows open. It’s a basic but important facet of proper house management, and it will also give you a clue about how to maintain siding and the lawn.

Learn Association Details

Find out if there’s an HOA or any similar type of association. If there is, read through their requirements. (Any competent Realtor will be able to get them for you quickly.) Note any fees and what they cover.

If there’s anything you want to change about a home, see if it’s allowed. If you want to park a vehicle or trailer, see if it is allowed. HOAs can have a lot of rules, in addition to monthly fees.

Find Out About Other Offers

Are there any other current offers on the house, or are there expected to be? A knowledgeable Realtor will have a good idea about this.

If possible, it’s also good to know who’s bidding on the property. An investor, for example, will often offer cash upfront and will make counter offers difficult. Remember that there’s always a certain amount of competition over popular houses.

Alleviate Risk with an Inspection

Buying your first home is likely the most costly purchase you’ve ever made, and it involves a head-spinning amount of details. Hiring an independent home inspector alleviates some of the risk for the 30-year mortgage you are assuming with the purchase of a home.

“We like to think of the home inspection as giving your home a health checkup before you plunge into the purchase agreement,” said Dave Kirwin of Kirwin Group Home Inspections. “The biggest risk involved in buying a home is missing the very expensive home repairs that aren’t obvious to the untrained eye.”

Make a Confident First Home Purchase

Hiring a home inspector gives the buyer another chance to review their decision before buying their first home. In a competitive home-selling market, signing the purchase agreement without a home inspection means the deal is done and the buyer has no recourse. This is true even for major problems like a leaky roof.

“We tell our home buyers, the inspection gives you a little breathing room to feel confident about the home,” Kirwin says. “Review the pros and cons, and double-check your thought process on the house.”

Home sellers would rather sell the house without the home inspection contingency. Yet, with a home inspection, if there’s something really wrong with the home, buyers can renegotiate or cancel the deal and get the earnest money returned.

Understand the Home Inspection ROI

Hiring a home inspector costs approximately $400. The ROI (return on investment) in hiring a home inspector is a drop in the bucket compared to the amount of dollars the buyer can save.

“We often find needed repairs costing up to $3,000 to $4,000,” Kirwin said. “We recently inspected a home where one corner of the house had settled unevenly. You could feel something wasn’t quite right and the room didn’t feel plumb. The siding and drywall was patched to mask the cracks. The foundation corner was four inches lower than the rest of the house.

“In this case, the buyer went back to re-negotiate repairs with the seller and the home inspection ended up saving the buyer several thousand dollars.”

Hire the Right Home Inspector

The best way to find a good home inspector is to ask friends and family. Find out who in your personal network has had an inspection done. After talking to your personal references, do an online search of home inspectors reviews and online presence. This will relieve some stress when buying your first home.

“We think it’s a good idea to interview two or three home inspectors to find out their level of experience and demeanor,” Kirwin said.

Get Input from Your Realtor on Home Inspection Needs

When buying your first home, talk to your Realtor about the home inspection process. Also, ask what they think is important for the home inspector to focus on for your specific needs.

The Realtor will advise you on the home inspection process. It takes three or four days to get the inspection and then a couple of days to report the results to the seller.

“Even with the home inspection, the home seller doesn’t have to make the repairs or adjust the price of the house, but the buyer then has the choice to buy the house knowing what repairs will cost or to walk away from the house,” Kirwin said.

Itemize Your Inspection List: Radon, Sewer, Chimney

Itemize the list of things you want checked during your first home inspection.

“If the home buyer wants specific additional types of things inspected such as radon, sewer or chimney, it’s important to request that from the home inspector beforehand,” Kirwin said. For example, a fireplace or chimney inspection requires a camera on a cable to look into the chimney flue and a radon test requires an electronic monitor.

“If these additional inspection options aren’t asked for upfront, the inspector may not be able to schedule and coordinate them for the buyer,” Kirwin said.

Come Prepared: Notebook, Camera, Tape Measure

After you’ve hired your first home inspector, you will most likely have a lot of questions. “Get a notebook and write down your questions as they come to you,” Kirwin said. “Bring the notebook to take notes, and don’t forget to take pictures.”

Remember to grab a tape measure. “The tape measure is one item most home buyers forget to bring,” Kirwin said.

Attend the Inspection

Home buyers should plan on attending the entire inspection. However, some buyers choose to not be present during the inspection. The inspection might be three hours long, but every minute of those hours is spent absorbing new information and allowing the home buyer to look around the house.

“We think one of the most invaluable benefits of hiring a home inspector is for the buyer to learn as much about the home as possible,” Kirwin said. “While we are making sure the home is structurally sound, the home buyer gets a chance to experience the house for an extended period of time without interruptions.”

Consider Weather Conditions During the Inspection

Be ready to be outdoors for part of your home inspection. “Plan on spending at least 30 minutes outside to learn everything there is to know about the home’s foundation, siding, windows, landscape grading and other outdoor concerns,” Kirwin said. “Wear clothing appropriate for the weather.”

Don’t Sweat the Details

Hiring a home inspector means the inspector is looking out for the first home buyer’s financial interest. The most important goal and primary purpose of hiring a home inspector is to protect your financial interest.

“We want to make sure first-time home buyers don’t get bogged down in cosmetic blemishes — a loose doorknob, a scratch on the floor, a worn light switch or a squeaky hinge,” Kirwin said. “These tiny things are $10 to $15 fixes. What we’re looking for are the very expensive repairs that aren’t obvious, such as structural problems or water damages in the basement.”

For cosmetic blemishes, home buyers can check out our guide for the DIY 10 minute home repairs and maintenance.

Consider Going Beyond an Inspection

Home inspectors can find a lot of things wrong with a house but they can’t always catch everything. Most home inspectors won’t climb on a roof to inspect, for example. Home inspectors typically don’t inspect underground pipes, septic tanks or wells, either, all of which are particularly expensive to repair or replace. Consider having the things they don’t check thoroughly viewed by an expert.

You can protect yourself by finding a home inspector who carries “Errors and Omissions” coverage. Find out how to fix a roof.

Check Out the Wiring

Homes built in the mid-’60s or ’70s might have aluminum wiring. If so, it should be determined if everything has been retrofitted properly. If it hasn’t, it could be a fire hazard, and replacement wiring can run thousands of dollars.

Save Enough

A NerdWallet survey of 2,200 home buyers and mortgage applicants found the biggest regret among millennial buyers was not saving more money before buying a house. About 11 percent of respondents no longer felt financially secure after they bought their home. Learn more about down payments and how they affect mortgage payments. Plus, how long it takes to save for a house.

Do Your Research

Nearly half of the respondents in that NerdWallet survey said they would do something different if they could. Near the top of the list was doing more research.

Forty-one percent of people who applied for a mortgage felt they weren’t aware of all their loan options. Many first-time homebuyers also aren’t aware of all of the costs associated with buying a house, especially the closing costs.

Buy Big Enough

Nearly 20 percent of millennial buyers and 20 percent of Generation X buyers in the NerdWallet survey said they regretted not buying a bigger house.

Plus, learn how to add square footage with a bump-out addition.

Don’t Forget About Future Development

When you have a specific house in mind, think about potential developments.

For example: If the home is near a busy road, will there be expansion in the near future? If there is a lot of open space around the home, will more homes be built in the area soon? If there are several homes for sale in the neighborhood, are they selling quickly, and who’s moving in? It may be difficult to find concrete information about future developments, but keeping some what-ifs in mind as you look can help you find your ideal home.

Also, keep in mind the potential resale value of your future home, because no one knows what the future holds. You may need to sell earlier than you imagined.

Consider the Commute

At a certain point, a commute becomes a burden. If your commute is taking valuable time away from your family or personal goals, look for a home closer to your work.

It may be worth it to downsize to a smaller home instead of losing too many hours every day to your commute.

Find a Realtor with Whom You Click

When looking for a Realtor, find one with whom you really have a connection. “It’s important to click with your Realtor,” says Donna Vanneste, a real estate agent with Coldwell Banker. “Does the Realtor feel honest and authentic? Can you tell they will be patient and educate you, so you can really learn and understand the market?”

Other things to ask yourself: Do you feel confident they are working on your behalf and not just trying to slam dunk you into a home to get the sale? Is the Realtor knowledgeable of the specific neighborhoods and areas you are interested in living so they can negotiate a good price for you?

It’s always a good idea to talk to a few of the realtors’ recent buyers to find out if they experienced good communication and follow up.

Location, Location, Location

First-time home buyers might be struggling with the dilemma of buying a home with more square footage versus buying a home in a hot area. Home values and selling the home down the line are important for the first-time buyer. When wrestling with this question, know that location truly helps maintain home values in all types of markets.

Neighborhood amenities are also important in assessing location when buying the first home. How close is the grocery store? What about recreation areas such as bike and walking paths? Is the home accessible to public transit? Lastly, homes on a busy street will always take longer to sell, and that usually translates to selling at a lower price.

Get a Garage

A one-car garage is better than no garage for maintaining home values. Two garage stalls are better than one, and for the first-time home buyer, a three-car garage is probably a nonexistent option.

No matter what size garage you get with your first home, have at least a one-stall garage. Find easy space-saving tips for the garage here.

Look Into Rambler or Ranch Houses

“One home style first-time buyers should definitely take a look at are the ramblers,” says Vanneste. The rambler is considered a plain home built in the mid-1900s, but these homes have the potential to give the first-time buyer more square footage per dollar.

Ramblers are often found in inner-ring suburbs, so offer excellent location with larger-than-normal city-sized lots. Another plus is the possibility of transforming the rambler from run-of-the-mill into exceptional one-level living.

Here are some good ideas for the first projects to tackle after you move into your first home.

Don’t Rule Out Split-Level Homes

Everyone has a parent or friend who “hated” their split-entry home. The reality is, many split-entry homes have been updated with bigger foyers and closets.

For the first-time home buyer, excluding split-entry homes might mean missing an affordable home option with nice features. Things like wood floors or a more open floor plan between the kitchen and living areas on the upper level.

Split-level homes also generally include three bedrooms on the upper floor, an amenity that helps maintain a home’s value. Check out how to build a custom closet to improve the split-level entry here.

Don’t Always Believe Zillow’s Home Price Estimate

Zillow is only a starting point in determining a home’s value.

They derive their estimated home market values with a proprietary formula that uses public and user-submitted data, taking into account special features, location and market conditions. This must not be mistaken for a bank appraisal.

First-time buyers need to be wary of the Zillow estimate in deciding whether a home is under- or over-priced and determining whether a home is a good market deal.

Get Personal

The first-time home buyer market is a tight one. Many homes may have more than one offer, turning the offer process into a full-on bidding war. Besides the financial winning strategies in a bidding war — such as doing a bigger down payment or upping your earnest money — there is one strategy that many home buyers may not think of on their own: Get personal with the seller.

Have a face-to-face conversation or write a letter to the seller about your family and why the neighborhood and home fit your needs. These are both excellent ways to stand out in a bidding war. Be sure to include a family picture, and of course a few compliments to the sellers on the maintenance and appeal of their home.

Show Up

Make sure you are present for the home inspection. Be prepared to ask questions and point out specific problems you’d like to check out further. This will be the first time your home inspector has been at the property, so your knowledge of potential issues is invaluable.

Find Your Own Home Inspector

Doing your homework to find a home inspector can really give you peace of mind. While your Realtor probably has a few inspectors that he or she can recommend, you should really find your own.

An impartial, third-party home inspector won’t have any loyalty to your Realtor and can talk freely and frankly about potential issues. You may have to pay a little bit extra for a quality home inspector, but compared to the purchase price of a house, it’s well worth it.

When searching for an inspector, here are two good places to start: homeinspector.org and nachi.org.

Don’t Be Afraid to Ask Questions

You hired a home inspector because he or she can evaluate whether this house has any issues that would make purchasing it a bad decision. And you should respect your home inspector’s knowledge and time. However, if something doesn’t look right or you don’t understand what a home inspector is referring to, speak up. It’s better to ask a question now than have an issue arise after you’ve purchased the property.

Learn more about potential issues — read about signs your house is in trouble here.

Get Pictures for Proof

Any home inspector worth using will bring a camera along on the inspection. The inspector will also be heading into places that you won’t want to go if you don’t have to (the roof, crawl space, under decks, the attic, etc.).

Ask your inspector to photograph any potential issues that arise so you can see them for yourself and make sure you fully understand the problem.

Infrared and thermal cameras can give you and your inspector a look behind walls and floors that you otherwise wouldn’t be able to see without ripping out drywall or flooring.

Because this technology is so accessible, your home inspector should use these pieces of equipment throughout the inspection. Some home inspectors may charge an additional fee for this service.

Do Your Own Pre-Inspection

You can really learn a lot about a house just by looking at it. Make sure you do your own home inspection and note any possible issues. Look at walls and ceilings for any evidence of water damage (discoloration, stains, etc.).

Try all the light switches and outlets to make sure the electrical layout makes sense. Peek at the electrical panel to see if there are any potential wiring issues. Look for new wire, old wiring that isn’t hooked up, etc.

On the outside of the house, look for drainage issues and areas with peeling paint. Check around decks and porches and inspect the siding. Going in to your official inspection, you should have a good idea of things you’d like your inspector to give extra attention.

Pay Attention to the Roof

A home’s roof plays a huge role in keeping the interior in good shape. It’s also one of the most expensive and labor-intensive parts of a house to replace. Try to find out when the roof was last replaced and whether or not any warranty exists.

Make sure your home inspector actually goes up on the roof during the inspection, unless it’s physically unsafe to do so. There’s only so much you can see while standing on the ground.

Keep eyes peeled for curling or missing shingles. Pay special attention to anywhere there’s a chimney, vent or skylight for signs of water intrusion. You can also see signs of water issues in the attic, if it’s accessible. Learn more about roof issues and necessary repairs here.

Look for Cosmetic Fixes

Freshly-painted walls and new floors are often signs a homeowner cares about the home they’re selling. But sometimes these things can also be cosmetic cover-ups of underlying problems.

Pay attention to any suspicious fixes — only part of a floor patched or repaired, or only part of a wall freshly painted — and ask your inspector to take a closer look.

Test GFCIs

GFCI outlets are part of the building code in rooms where moisture is present (kitchen, bathroom, laundry room, etc.). Your inspector will know how to test these outlets properly, and malfunctioning or non-working GFCI outlets could hint at bigger electrical problems. Learn how to test GFCIs here.

Look in the Attic

A well-functioning attic is crucial to protecting a home. If your home inspector can get into the attic without trampling insulation, you can often learn a lot about the home and any renovations or repairs.

One common inspection red flag is improper venting of bathroom fans into the attic (and not extending the vent all the way through the roof). If your bathroom fan is venting directly into the attic, it’s sending moisture and humid air where it can cause mold, rot or worse. It’s also not up to code.

If possible, have your inspector check for attic air leaks. While you can fix these, an attic with air leaks could have potential issues with insulation, moisture, mold or worse.

Give the Plumbing a Try

Losing water pressure or dealing with a slow drain can be indicators of larger plumbing issues. Make sure bathtubs and shower pans are leak-tested. And have the home inspector inspect the water main and shut-off points (useful knowledge if/when you take ownership of the property).

Get Furnace and Water Heater Details

Beyond making sure the furnace and water heater work properly, you should find out how old each one is and the last time each was serviced.

Replacing a furnace or water heater can be pricey. If either needs replacing soon, keep that in mind while putting together your offer on the property.

You can also get a feel for how the furnace is cared for by checking the furnace filter. A filter that’s in obvious need of changing can hint at other postponed or ignored maintenance.

Don’t Forget the Basement

An unfinished basement will give a lot of clues to the condition of the house and foundation. Look for cracks, signs of repairs and water issues. A crack in the slab or wall is not always a deal breaker, but understanding why a crack appeared is important.

Your home inspector will be able to tell you if anything needs further inspection from a structural engineer.

Tackle One Project at a Time

When we first bought our old house, I tore right into a porch and kitchen remodel and started on a fence. Before I knew it, I had the whole house AND yard torn up. Ultimately it all came together, but there was a lot of added stress with everything going on at once. — Kirk Pennings

Home improvement causing stress in your marriage? Learn how to DIY without divorce here.

Verify Everything

Insist on a full written disclosure from the seller about remodeling, repairs, old damage, leaks, mold, etc. Check with the city or county, and get — in writing — the property’s permit history, zoning, prior uses, homeowners’ association restrictions and anything else you can find out. Forget “location, location, location.” I say, “Verify, verify, verify!” — Paul Bianchina

Check Crime Stats

Before buying, get a report of police calls in the neighborhood. A bargain price may be due to the crime rate in the area. — Mike Collins

Get a Home Warranty

We had the seller throw in a home warranty. This saved us from a faulty dishwasher and got us a new furnace. — Larry Gusman

Ask Neighbors About Pros They Trust

If you’re looking for plumbers, electricians or other pros, ask your neighbors. You tend to get good advice if you ask people who live near you. — Bob Bessette

Offer to Buy the Tools Too

If you buy from a couple that’s downsizing, you might get a great deal if you purchase their garden tools, tractors, snow blowers and tools in general. — Alena Horsky-Gust

Budget for Trouble

We bought a house with an old furnace, and we knew it was going to go. Sure enough, the first winter did it in. But since we were prepared, it was just an expense, not a financial shock. — Pat Minick

Use a Buyer’s Agent

Shopping for a home can be a daunting process without the assistance of a buyer’s agent. This is your agent who exclusively represents you. Typically the agent is paid via the seller.

“In most cases, there is little to no cost to work with a buyer’s agent,” says Veronica Sniscak, Realtor and partner at Bob Lucido Team of Keller Williams Integrity. “Buyer’s agents will help you navigate the home-buying process and negotiate the best price and terms.”

Be Wary of Using a Dual Agent

Using a dual agent is akin to using the same attorney for both spouses in a divorce. It may not be in your best interest. And in some states, dual agents are restricted or illegal.

“A dual agent represents both the buyer and the seller in the transaction,” says Michael Trickey, CPA and author of Finding Home: Everything You Need to Know-and Do-For Home Buying Success. “This can arise if a buyer calls the selling agent of the home. The agent is obligated to disclose the relationship to both parties as this can cause a conflict of interest.”

Understand Any Easements

Your dream home may include a shared driveway, private road or a portion of property that a local utility must access to maintain elements on poles or buried underground.

“When someone is granted an easement, they are granted the legal right to use the property, but the legal title to the land itself remains with the owner of the land,” says Trickey.

Check out these vital home maintenance tasks you need to know.

Earnest Money

It’s time to show how serious you are about buying the house with earnest money, also known as a good-faith deposit. “This money shows that a buyer is willing to sacrifice money to put toward a home’s down payment, thereby hoping to secure the purchase of a property,” says Trickey.

The money is credited to the balance due at closing when certain conditions have been met, or refunded in the event the offer is not accepted.

Seller Concession

“This is a monetary gift, deal or some other agreement that benefits both buyer and seller,” says Shayanfekr. “A seller concession can be applied towards closing or repair costs.”

A concession is most likely the result of a finding in the inspection report, such as a damaged roof or problems with electrical wiring. These home repairs take 10 minutes or less.

Title Curation

If an issue is found in the title, such as a prior foreclosure on the property, but the foreclosing party is not the same as the holder of the Promissory Note, it doesn’t necessarily mean the deal is dead.

“It is important that you make sure an attorney who specializes in title curation is involved,” Pellegrini says. “It is best to proactively involve a title curation specialist immediately after a defect is discovered.”

TRID

This term involves acronyms on top of acronyms. Previously the TILA (Truth in Lending Act)/RESPA (Real Estate Settlement Procedures Act) Integrated Disclosure Rule, the TRID is a lending regulation to help borrowers fully understand the terms of their loans.

“It is an effort to help borrowers better understand the actual costs of borrowing and has strict disclosure timelines on utility readings and when the financing terms must be disclosed to the borrowers/buyers,” explains Pellegrini.

“Most Purchase and Sale agreements should discuss TRID and what will happen if one of the deadlines is not met. Otherwise, the buyers could default on the agreement and lose their deposits at the last moment.”

Check out this first-time homebuyers guide to home maintenance.

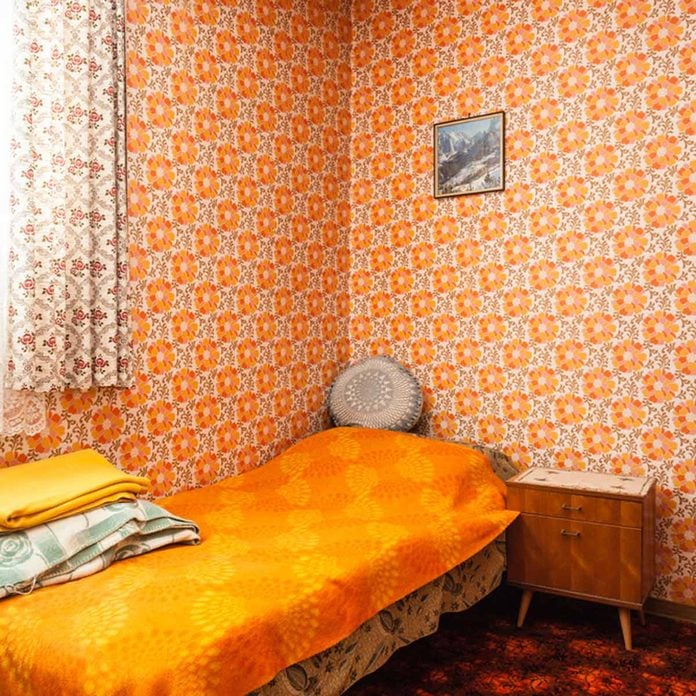

Understand Renovation Limits

Most of us like to think that when we own a home we can do whatever we want with it. The reality is that we have to take into account municipal regulations as well as any homeowners association requirements.

Zoning and permits vary greatly from area to area, and every homeowners association is an entity unto itself. But no matter where you live, some home improvements will improve the market value of your home, while others will have no effect, or might even make it harder to sell when it’s time.

So feel free to go with orange and brown vintage wallpaper if that’s the look you enjoy; just understand that potential buyers might not feel the same way about it as you do. Do a little research into what projects will earn you the biggest return on investment, starting with this great overview.

Understand Insurance

Most mortgages require specific amounts of insurance to be carried by homeowners. It’s certainly aggravating to be required to spend money, but mortgage companies don’t do it just to be irritating. They require insurance because a home is a terribly expensive thing to replace.

Far too many homeowners finally manage to pay off their mortgage only to suffer a tragedy due to fire or natural disaster. Their loss is compounded when it’s discovered that they dropped their homeowners’ insurance once they were no longer required to have it.

Insurance payments may feel like money going out the door, but that’s only when you don’t need it. And when you do? Well, then it’s too late. Of course, just because you should carry insurance is no reason not to search for ways to reduce its costs.

You Can’t Time the Real Estate Market

Those who’ve been in the property business for any substantial amount of time can recall neighborhoods that were supposed to “pop” for years, or even decades, but for some reason never got started. All the buyers who moved in expecting a windfall were disappointed, even if their individual home was perfectly fine.

Concentrate on finding the right home for you and your family instead of trying to win the housing lottery and you’ll be much happier in the long run. Busting this myth is one of the most essential things a first-time home buyer can learn.

The Lowest Interest Rate Isn’t Always the Best Mortgage

A mortgage loan is incredibly complicated. Any real estate professional can regale you with endless tales of loans and closings going off the rails for one reason or another. With so many ways for things to go wrong, you want to pick a mortgage lender who understands the business and will work with you and your real estate agent to achieve the goal you all want: closing on a home.

Depending upon where you live, a common issue for mortgage lenders is getting comparable properties (comps) to make sure that the mortgage is properly secured. Because so much of real estate is local, the comps can easily be off in one direction or another.

A mortgage lender who is local to your area will understand that comps a half-mile to the east are accurate, while a comp from just a block west may be in a different price range entirely.